GreenSquareAccord and The Risk of Downgrading and the Dangers of Rushed Mergers

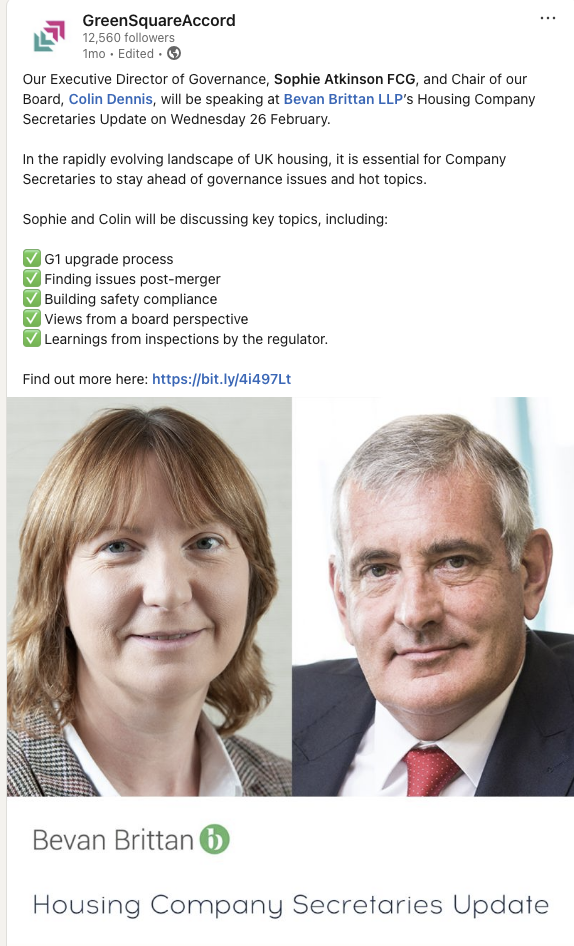

Last month, GreenSquareAccord announced across various social media platforms an upcoming event where Sophie Atkinson, Executive Director of Governance, and the newly appointed Chair, Colin Dennis, would offer their insight and knowledge on key issues facing the housing sector. Hosted by Bevan Brittan, a long-time provider to GreenSquareAccord, the event was marketed as an opportunity for sector leaders to demonstrate their leadership and expertise. Bevan Brittan’s longstanding relationship with GreenSquareAccord, coupled with the event’s promotional tone, framed it as a prestigious occasion to showcase the organisation’s governance strengths.

However, despite the initial presentation as a moment for GreenSquareAccord to highlight their leadership, the content revealed during the event has instead raised more concerns than answers. The very issues GreenSquareAccord tried to present as evidence of leadership—such as the ongoing regulatory challenges, the failure to resolve basic safety issues, and the unconvincing defence of a rushed merger—only underscored the organisation’s inability to fully address the foundational problems still plaguing them. Rather than reinforcing their position as sector leaders, the event further highlighted the significant gaps in governance, accountability, and the ongoing risks to the safety and well-being of their residents, as well as some truly worrying attitudes towards public safety and compassion.

The Rushed Merger - A Failure of Due Diligence

The merger of GreenSquare and Accord in 2021, touted as a way to create a stronger housing association, was marked by glaring issues from the outset. It was a merger of necessity, not strategy, with due diligence seemingly thrown out the window. The immediate fallout was palpable—poor governance, incomplete safety checks, Housing Ombudsman investigations, and a lack of transparency about the state of the properties under management. Rather than a fresh start, this merger revealed deeper problems that neither provider had addressed before joining forces.

GreenSquareAccord’s downgrade from a G1 to a G2 rating was directly tied to these issues, and yet, it seems that the response has been more about managing public perception than actually fixing the root causes. Sophie Atkinson herself acknowledged the extent of the problems, stating:

"It became clear immediately post-merger that there were some unanticipated issues that were emerging, and we needed to do something around strengthening governance and have a bit of an action plan around kind of compliance."

Safety First? Or Afterthought?

Atkinson attempted to deflect responsibility for these issues, saying:

"And there was the sort of raging world around us of kind of post-Grenfell, and of Awaab's Law coming out, of changes in legislation, of increased fire safety legislation, of costs of the economy. So there was a lot of things being thrown at us as an organisation at that time, which I think overcomplicated things in a way that wasn't particularly helpful."

This statement not only downplays the severity of the situation but also implies that external events were to blame for their failure to act on basic safety requirements.

Sophie Atkinson’s remarks about how they were “hindered” by the fallout from Grenfell and Awaab's Law are not just misguided—they are in poor taste.

These are not new issues. Fire safety, electrical testing, and asbestos checks have been basic requirements for years. GreenSquare and Accord, and now GreenSquareAccord, should have already been providing homes that were safe, warm, and dry before they were forced to comply with stricter regulations. The ongoing lack of adequate checks on so many properties is not just a regulatory failing; it’s a direct threat to the safety and well-being of residents.

How many properties are still at risk because of outdated electrical systems or untested asbestos? How many homes remain unsafe because of a failure to meet the most basic safety standards? These questions should be front and centre, not buried under excuses and regulatory and remorseless jargon.

To provide some background, I’ve met Sophie Atkinson twice, both times in court. Although she made claims in her affidavit that were ridiculed by the judge, she struck me as a decent person doing her best under the threat of having to carry out her duties in order to keep her role. I didn’t believe she thought her actions were just, but rather that she was forced to act in a way that defended the company she worked for. She didn’t attend the final, failed court action, having employed a head of legal to take her place in such frivolous and costly proceedings.

Mergers and the Fallacy of Bigger is Better

Mergers like the one between GreenSquare and Accord, often driven by financial pressures, raise significant concerns about the long-term health of housing associations. When one provider is failing, merging with another does not automatically solve the problem; in fact, it often exacerbates it. Instead of focusing on fixing existing issues, resources are diverted to managing a larger, more complex organisation with even more problems to address. This is exactly what we see with GreenSquareAccord.

The constant focus on expansion, rather than focusing on fixing the existing issues, signals a concerning disregard for the quality of service to existing residents.

The focus should be on delivering quality homes, not on chasing growth for growth’s sake. Yet, it’s clear that the CEO’s focus remains on securing more stock and pleasing investors, rather than prioritising the people who rely on them for safe housing. Atkinson’s comments that the merger was a "good problem to fix" are indicative of an institutional mindset that is more concerned with managing public relations and appeasing stakeholders than genuinely tackling issues head-on.

A CEO's Focus on Investors, Not Providers

The fact that GreenSquareAccord has made securing additional funding options a priority post-merger speaks volumes about their leadership’s priorities. Atkinson herself noted that they "secured increased funding options after the merger," which only further highlights the financial motives behind the merger rather than a true commitment to residents. The rush to grow and bring on more stock speaks not to a commitment to better service, but to a desire to keep investors happy. Atkinson’s emphasis on managing this process effectively is not enough to excuse the fact that residents’ safety remains secondary to financial growth.

At what point do housing associations need to stop growing and start fixing what’s already broken? The growing focus on satisfying investors over residents is a dangerous trend, one that prioritises short-term growth over the long-term sustainability of the housing sector.

Is the Upcoming Downgrade a Concern?

Perhaps the most troubling aspect of GreenSquareAccord’s journey is the lack of genuine concern for the potential downgrade back to a G2 rating. Atkinson’s downplaying of the significance of this possible outcome raises serious questions. When she stated:

"The decision to upgrade us to a G1 was, quote, finely balanced"

It seemed as though GreenSquareAccord was more concerned with the appearance of progress than addressing the fundamental issues that led to their downgrade in the first place.

How can an organisation responsible for thousands of homes, many still not fully compliant with safety regulations, act so blasé about the risks to their reputation and the safety of their tenants? Atkinson also revealed that;

"We are in the slightly awkward category of being a kind of housing association with a regulatory notice that therefore doesn’t fit in a box"

Which illustrates just how far GreenSquareAccord has fallen short. The focus should be on fixing the core issues, not navigating a flawed grading system.

A Wake-Up Call for Housing Associations

Housing associations like GreenSquareAccord must be held accountable for their failures, both past and present. The safety of residents cannot continue to be an afterthought. As mergers continue to be seen as an easy solution to financial struggles, it’s crucial that the sector shifts focus back to what truly matters—providing safe, secure homes and ensuring that housing providers are fit to do so. As Atkinson acknowledged, "You need to look at everything. Root and branch review of governance" is necessary. If this does not happen, we will see more housing associations, like GreenSquareAccord, continue to spiral into mediocrity, driven by short-term financial goals rather than the long-term security and well-being of their residents.

Perhaps the real concern among the higher echelons of society—from housing associations to governing bodies like the National Housing Federation—is the potential fallout if a housing association were to collapse. Would it lead to a dip in the shareholders of BlackRock? Could the repercussions trigger an economic downturn, or even reach a global scale? It seems this fear may explain why some Housing Association CEO’s appear so indifferent to the situation—they know failure is simply not an option for them, and the forces in place will ensure that they don’t fail…